Economy

Country resources

This is a list of resources country owns. Resources are:

|

|

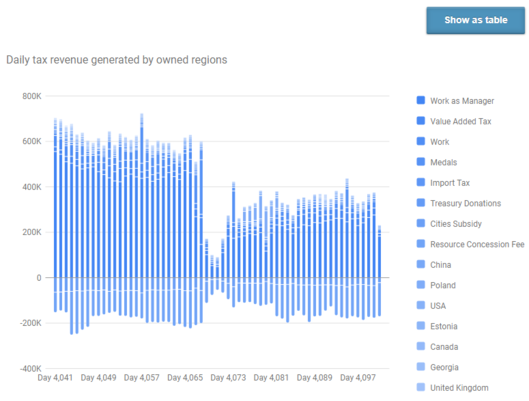

Tax Revenue

Countries can gain additional tax income from the regions they have conquered. The amount of currency collected through taxes is updated in real time both in the country treasury and in the Tax Revenue chart.

The taxes of country under partial or total occupation are divided between the occupying countries and the country that is occupied. The taxes are affected by the number of regions each country holds.

The taxes included in the calculations are:

- Import tax

- VAT (Value Added Tax)

- Work tax

PCI = TC × (CR/OR × 80% + BI )

- PCI: Partial Country Income

- TCI: Total Country Income

- TC: Tax Collected

- BI: Base Income (20% for the country collecting the tax)

- OR: The number of original regions of the country

- CR: The number of original regions currently under control

The total income of a country (TCI) is the sum of PCI’s calculated for the original and non-original regions the country possesses.

For example, Finland controls a part of its original regions, but has also occupied regions from Greece and Belarus. Finland’s TCI will be: TCI = PCI(Finland) + PCI (Greece) + PCI (Belarus)

Please note: that even if a country has 0 regions, the base income is still 20%.

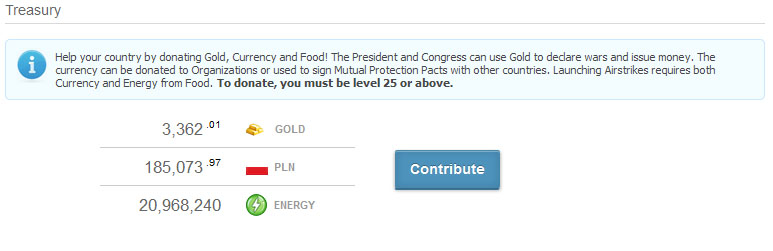

Treasury

The treasury section displays the country's gold and national currencyaccount.

Trade Trade embargo

The trade embargo section lists the embargoed country name, and flag, expiration date.

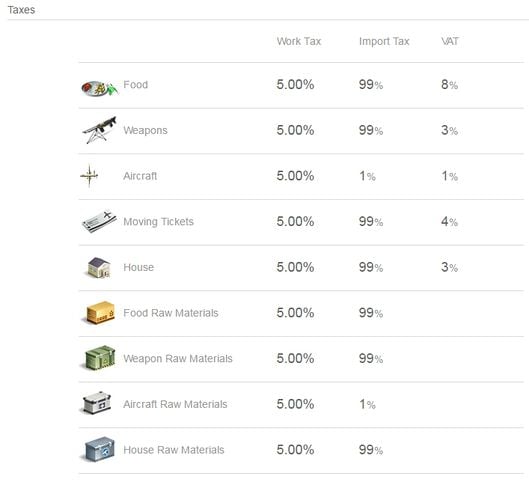

Taxes

The tax section lists for each manufactured product and raw material:

The VAT is only added on manufactured goods.

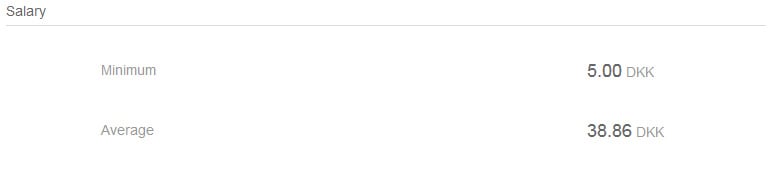

Salary

The salary section lists the:

- Minimum salary (voted by the congress)

- Average (the average salary based on the last 30 days paid salaries in the country)